Actual disabling Google Pay in Russia led to the fact that Android users began a mass migration to domestic contactless payment services. Because of this MirPay experienced such a load that for several days after that it worked with failures. Now everything seems to have settled down, the service has fixed all the errors, and users can again pay by phone, as before, without remembering Google Pay and Samsung Pay. And everything would be fine, but Russian banks suddenly began to promote a new way of mobile payments using QR codes. So, you need to figure out which one is better.

Mir Pay is not even close to the System of quick payments with payment by QR, but you still need to compare them

ПОДПИШИСЬ НА НАШ КАНАЛ В ЯНДЕКС.ДЗЕНЕ. ПОДДЕРЖИ НАС

What’s happened QR payment and how it works, we told in a separate article. You can read if interested. Here we will focus on the main differences contactless payments via SBP and Mir Pay, let’s figure out how convenient both services are and see if one can replace the other.

Contactless payments by phone

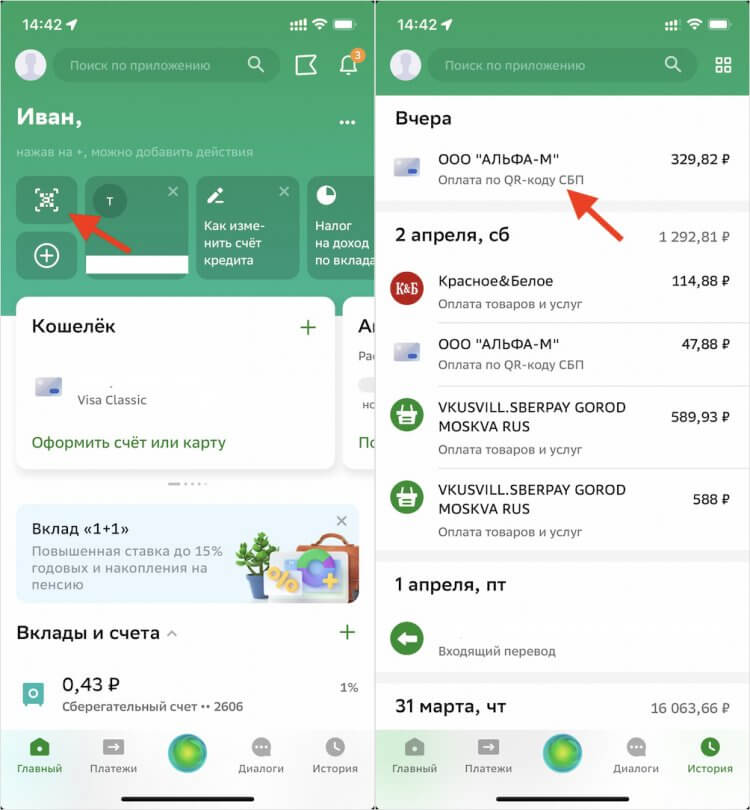

You do not need to install a separate application to pay by SBP. The transaction is made through the mobile client of your bank using the QR code scanning function

key the difference between Mir Pay and the Fast Payment System (SBP) is the method of making a payment. Through Mir Pay, payment is made in the form of an NFC token, and through SBP – by transfer from the buyer’s account to the seller’s account, the details of which are sewn into a QR code. Purely technically for the user there is no difference. But from a practical point of view, it is.

Benefits of MirPay:

- Instant payment;

- Payment without the Internet;

- Possibility to get cashback;

- Credit cards supported;

- A wide range of stores where you can pay by NFC.

Disadvantages of MirPay:

- You need an expensive smartphone with NFC;

- A bank terminal is required;

- There is no support for online payment;

- Only PS Mir cards are supported.

Advantages of payment via SBP via QR:

- Optional terminal;

- Additional discounts due to cheap acquiring;

- Support online payment;

- No card needed (debited from account number).

Disadvantages of payment via SBP via QR:

- Credit cards are not supported;

- You can not get cashback for purchases;

- Not everywhere accepts payment by QR;

- Payment only from the banking application.

ПОДПИШИСЬ НА НАШ ТЕЛЕГРАМ-КАНАЛ, ПОКА НЕ ЗАПРЕТИЛИ

Logically payment via MirPay looks more attractive, if only because of the support of credit cards, if only because of the opportunity to receive cashback, if only because of a wider range of stores where there are contactless terminals. But you need to understand that users smartphones without NFC, there is generally no way to pay for purchases through Mir Pay. After all, it does not even support online payment.

Accordingly, SBP looks a little more versatile. First, it allows you to pay online. Many online stores and marketplaces support QR payment and even provide a discount for its use. Secondly, you can pay for purchases using SBP even where there are no terminals. This approach is often practiced in small catering establishments, corners in shopping centers or in parks.

How to pay by phone without Google Pay

When paying by QR, you kind of get a cashback in advance and in rubles

Essential lack of SBP is the lack of support for credit cards and cashback, because transactions by QR codes registered as a transfer of funds. This is due to the fact that banks receive almost nothing from stores for service, which is why they simply have nothing to refund you. But on the other hand, many retail chains offer discount 1% of the purchase amount, compensating for the lack of cashback.

In some cases, it may even be more profitable. Well, see for yourself: most banks award cashback with points, and you can spend it only when you have accumulated the required amount. And most often you can not pay the entire cost of the purchase with points. And with the SBP, you kind of get a preventive cashback, and right away, which means you don’t have to wait for the end of the month, and in rubles.

Привязать кредитку с СБП нельзя, потому что платежи проводятся как денежные переводы.

Привязать кредитку с СБП нельзя, потому что платежи проводятся как денежные переводы.

Can Mir Pay replace SBP or vice versa? Well, of course not. These are different means of payment, which differ not only in the way transactions are carried out, but also in the conditions under which the payment is made. It is clear that if you pay for a purchase on Wildberries, Mir Pay will not help you, and you need to contact the SBP. This will avoid the use of cards, and at the same time will allow you to get cashback.

But, if you pay for purchases exclusively with a credit card, because you get an increased cashback on it or just keep money on a debit card so that you get interest on the balance every month, then SBP will not help you here, alas. In this case, it would be most logical to use Mir Pay or, at worst, the plastic card itself. So to say which is better: Mir Pay or SBP, it is forbidden. Each service has its own application scenarios, which almost do not intersect with each other.

The post Which is better: Mir Pay or pay by phone via QR appeared first on Gamingsym.